What is a Bear Market?

What is a bear market? You may hear it when listening to the news, people talking about it in groups, but do you know what it means to you as a stock market investor? Knowing what it is and how it affects your trading can be a key to losing a lot of money or making a big gain.

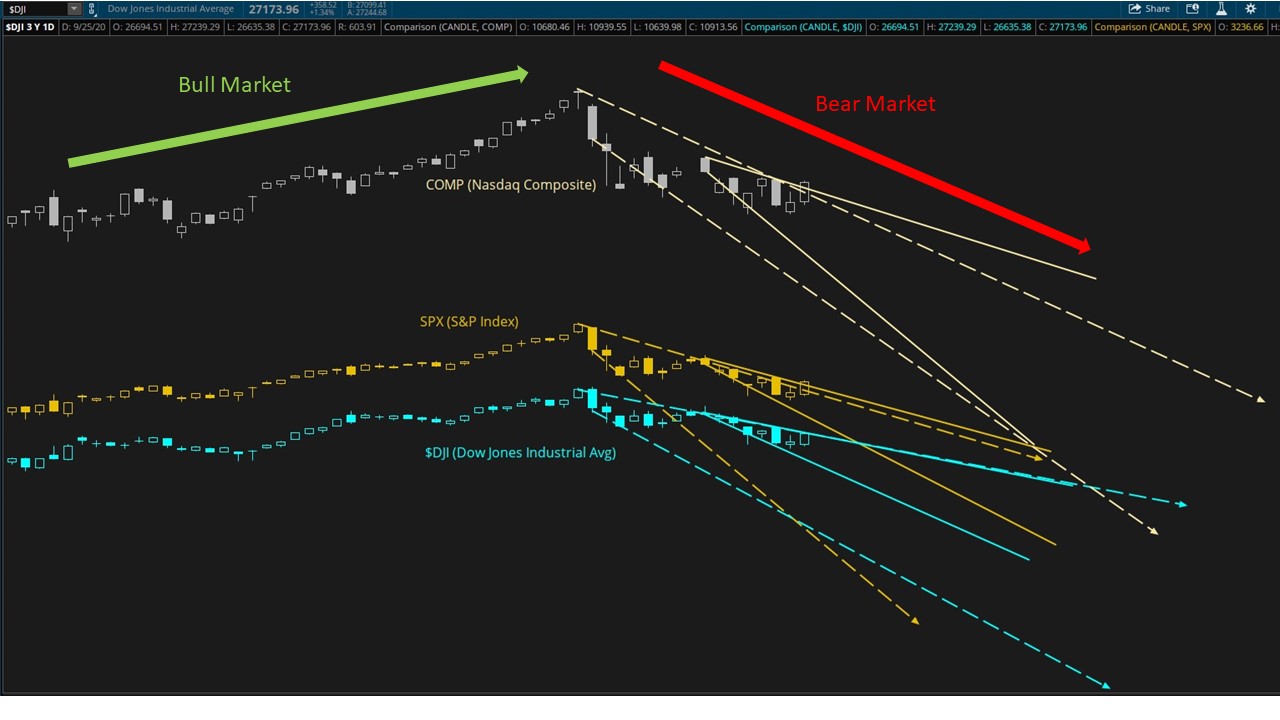

The stock market as a whole moves up and down every day. So do stocks. But, over a period of time, the overall movement, or trend is either up or down. There are other fancy words used in the stock world for these trends that can make it difficult for a beginner to figure out what's going on.

Learning all about a bear market will help you know where it came from and how it helps you while analyzing stocks.

What is a Bear Market and Why Does it Mean Stay Out of the Market for Certain Investors?

What is a bear market? It is defined as a significant drop in stock prices from their recent highs. This can be referred with the overall stock market, individual stocks, or sectors. This is different from a trend down, as all stocks trend up and down in price in a normal oscillating fashion.

But when a stock's price trends down over 20% from it's recent high point, it falls into what is a bear market in all intents and purposes, and this can be a very dangerous place to trade stocks for some stock market investors.

It can also be called a "bearish" stock when the price has been trending down for a considerable amount of time.

A price can also be bearish if it closes lower than it opens in a day.

If you are a buy/hold/sell stock market investor, you concentrate your efforts on a bull market. If the market enters a bear stock market, stocks don't spring back up as expected based on stock market indicators.

How Did the Term Bear Market Enter the Stock Market?

The bear reference has been used in trade since the early 1700's and has stuck around since. The term bear came from the way the animal attacks, striking downward on its opponent. So, an easy way to remember it is that a bear attacks down (the stock price is going down).

The first big bear market was in 1929 during the Great Depression.

Just as there is a definition for what is a bear market, there is a definition for a trader who thinks the market prices will go down or has a pessimistic outlook for a stock. Bears usually get out early or trade on the down, buying put options with a future outlook of down price.

How to Determine When a Bear Market is Over

The bear market happens in four phases and you should be familiar with each one so you can recognize when the market is turning in the opposite direction.

Phase 1: This phase has high prices and high investor confidence. This is the point investors start taking profits and drop out of the market all together.

Phase 2: Stock prices fall fast, trading and company profits drop, and economic indicators go below average. This is where panic sets in and capitulation occurs (people sell their positions no matter where they are).

Phase 3: People start to become speculative and start to re-enter the market in hopes that it is turning around. This raises some stock prices and trading volume increases.

Phase 4: Stock prices continue falling, slowing down from the steep declines in Phase 2, but they continue to drop. You are looking for good news and low prices, which will lead into a frenzy of buying, known as a bull market.

What is a bear market? It is a long term decline in a stock price or index that takes stock prices to very low prices. Once it hits the bottom, it is the optimal time to get back in the market. This is when a bull market begins and buy/hold/sell investors make the most money.

New! Comments

Have your say about what you just read! Leave me a comment in the box below.