The Stoch RSI Indicator and its Trading Signals

The Stoch RSI indicator is a very useful signal generator for somewhat volatile stocks. It combines two common studies into one powerful tool to apply to your trading decisions each day.

The Stochastic RSI indicator is half Stochastic Oscillator and half RSI (relative strength index). By using the two, it is able to generate a more precise tool with two separately sourced lines (a FullK and a FullD) that oscillate between an overbought and oversold condition.

The Stoch RSI Indicator Explained

The RSI, or Relative Strength Index, is the primary fuel for the indicator. It is based on the strength of a stock price on a 0 to 100 scale. To obtain this strength value, it compares the magnitudes of recent gains and losses.

It is very similar to moving averages and is treated the same, using any of the five types of moving averages (simple, exponential, Wilder's, weighted, or Hull) to make the calculation. By default, the plot uses Wilder's moving average, but you can choose others to tweak the signals for the best results.

Relative Strength is primarily an indicator of oversold or overbought condition of a stock. The default values generally run at 70 for an overbought line and 30 for an oversold line. However, in the Stoch RSI, these numbers are set to 80 and 20 which gives a more precise and better timed indication. Learn more about overbought and oversold to learn why this is a very important time for a stock.

The relative strength Index by itself is only one line that oscillates between 0 and 100. This only produces two types of signals: Crossing overbought, which indicates price is ready to shift down, and oversold, which indicates price is ready to shift up.

By adding it into a Stochastic Oscillator, there are two opposing lines that produce a better crossing signal and more accurate trend shifts.

Stochastic RSI Chart Setup Parameters

There are several key parameters to consider when setting up this indicator. The numbers can be adjusted to tune in your charts, but will work just fine with the default settings of the study.

For the inputs, the indicator uses the following:

RSI Length: This is the number of price bars used to calculate the relative strength indicator.

Overbought Line: This is set to 80 for this indicator.

Oversold Line: This is set to 20 for this indicator.

The RSI Average Type: This is where you choose the average type such as simple, exponential, Wilder's, weighted, or Hull. The default is Wilder's and tends to work well with this indicator.

RSI Price: This is when you want price figured into the indicator. This is usually at the Close but other choices are available.

K Period: The K period is the period where the highest and lowest prices are found.

D Period: The length of the moving average that will be applied to FullK in the plot.

Slowing Period: This is the length of the moving averaged applied to %k which produces the FullK plot.

Average Type: This is similar to RSI Average Type but uses simple by default. You can choose other types.

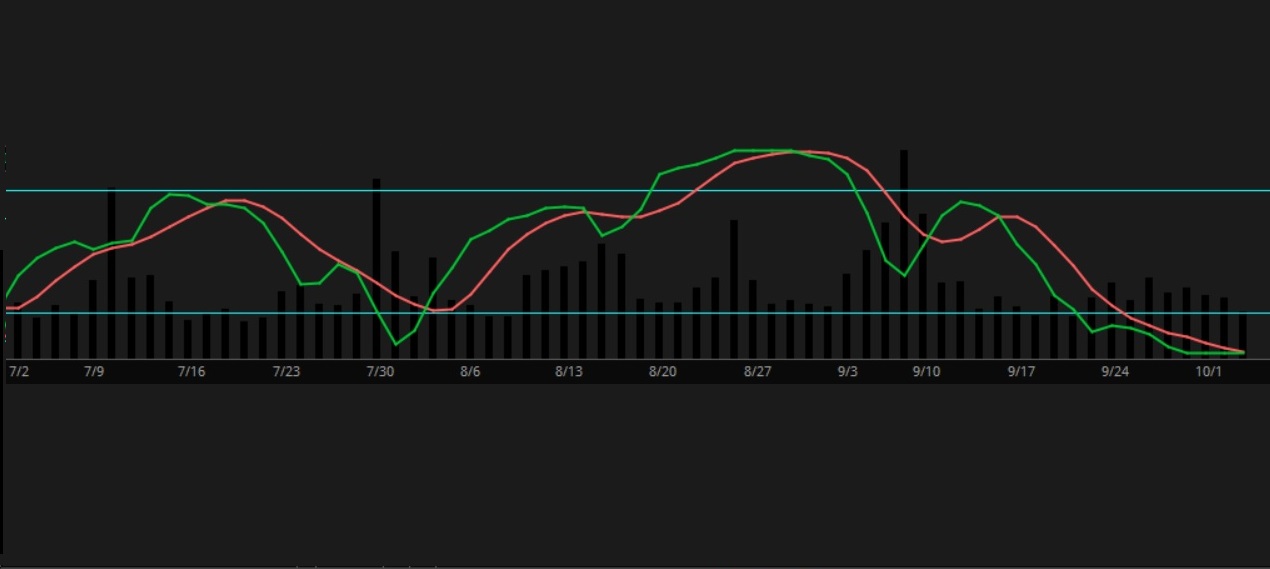

I personally don't like the colors they use in the plot, so I make my FullK Green and my FullD Red for the indicator so I can better see the cross and know which direction the indicator is pointing. I will explain this is a little bit.

What are the Buy and Sell Signals of the Stoch RSI?

The signals for the Stoch RSI indicator are great when used with other chart studies. Never make a trade based on one indicator's signals. Always use a combination of evidence to determine the proper trade.

All in all, there are five (5) different kinds of signals on the Stoch RSI Indicator that tell you when to buy or sell a stock or tell something about the price trend. They are as follows:

1. Crossing FullK and FullD Lines. There are two signals that are produced, either a buy or sell signals based on the direction the FullK line (green) crosses the FullD Line (red). If, for instance, the FullK crosses the FullD up, it indicates a buy.

2. FullK Dropping Below the 20 Line or Rising Above the 80 Line. When the FullK line drops below the 20 or oversold line, this is "cocking the gun" so to speak. Once it drops below the oversold line, this indicates the stock price will be changing up soon based on the supply and demand model. Inversely, when the FullK rises above the 80 or overbought line, this indicates the stock price will be changing down soon based on supply and demand.

This is a good precursor indicator for price movement, not a signal to buy or sell.

3. FullK Drops Below the 80 Line or Above the 20 Line. After the gun is "cocked" it is ready to fire. It "fires" when the FullK line crosses down through the 80 line after being "cocked". It can also "fire" up when it crosses up through the 20 line after being "cocked".

This "firing" cross is a buy or sell signal.

4. Price Trend. Price trend can be determined by which direction the FullK line is moving. If it is moving up, the stock price is typically moving up. If it is moving down, the stock price is typically moving down. The trend should be figured by placing trend lines between the highest and lowest point of the FullK line.

5. Price Trend Reversal. Since the FullK is not always a stable, rising or falling oscillation, this indicator is a little more difficult to use. You must draw a trend line on the FullK and connect all of the lower valleys in an upward or connect all of the peaks in a downward trend. If the FullK crosses through that trend line, it is a sign of a possible price trend reversal.

Any combination of these signals can be used as a decision point to buy or sell stocks, but like I said before, don't rely on the Stoch RSI indicator alone. Use it with other signal indicators to determine the best time to buy or sell a stock.

New! Comments

Have your say about what you just read! Leave me a comment in the box below.